How Much Does Education Really Cost in Australia? Here’s What Every Parent Should Know (2025 Edition)

Curious what school will really cost your family in 2025? From public to private, here’s the latest data on Australian education costs — and smart financial planning strategies to help you stay ahead.

Education is one of the most powerful gifts we can give our children.

It shapes who they become, how they think, and what kind of future they believe is possible.

So it’s no surprise that most Aussie parents say education is one of their top financial priorities — even more than holidays, renovations, or early retirement.

But with cost-of-living pressures rising and schooling costs creeping up year after year, the big question remains:

How much do we actually need to budget for our children’s education — and what’s the smartest way to plan for it?

Let’s break it down.

What Schooling Will Cost You in 2025

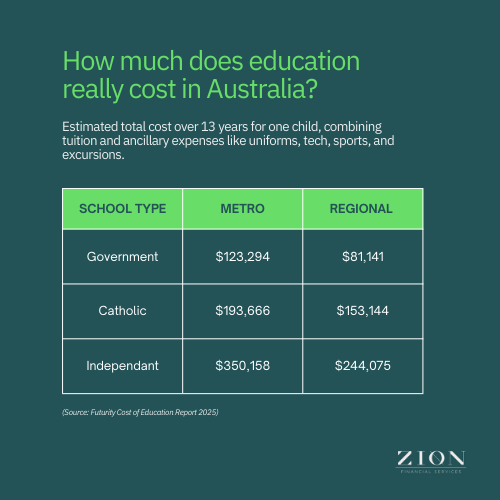

The latest 2025 Cost of Education Report from Futurity reveals the estimated total cost of sending one child through 13 years of schooling, combining both tuition and ancillary expenses like uniforms, tech, sports, and excursions.

For families with multiple children, these figures can quickly climb into the hundreds of thousands — which is why long-term planning matters.

The Hidden Extras: It’s Not Just Tuition Fees

Many parents are surprised to learn that non-tuition costs can make up a significant chunk of the total spend.

These include:

Uniforms and school supplies

Digital devices and tech subscriptions

Extra-curricular activities and sports

Private tutoring or exam prep

School camps, excursions, and transportation

In 2025, these ancillary expenses have increased in line with inflation — especially technology and activity costs.

Parents Are Intentionally Planning Ahead — But Confidence is Mixed

According to the report:

85% of parents say education is extremely or very important to their child’s success

81% feel overwhelmed by financial pressures, but…

49% say they are actively preparing for the costs

Yet only 34% feel confident they’re financially equipped to contribute long-term

In other words: the intention is there — but many families need more support and structure in their planning.

Why a Smart Education Plan Makes All the Difference

Education is a long game. And like any big investment, the earlier you start planning, the more confident (and flexible) you become.

At Zion Financial, we help families:

Forecast what education will realistically cost across different school types

Create an Education Savings Strategy tailored to your lifestyle

Explore investment options like Education Bonds or Family Trusts

Plan for multiple kids and varied schooling choices

Balance education goals with other priorities like travel, home upgrades, or early retirement

Whether your child is starting prep next year or already in high school, there’s always time to take the pressure off with a personalised plan.

This Isn’t About Cutting Back — It’s About Getting Clear

A good financial plan doesn’t mean saying no to your lifestyle or making rigid sacrifices. It means:

Knowing what’s coming (no surprises)

Making empowered choices for your family

Avoiding unnecessary debt or stress

Giving your child access to the opportunities that matter most to you

Even small steps now — like setting up a savings account, speaking to an adviser, or reviewing your budget — can make a big difference over time.

About Zion Financial – Trusted Financial Advisers on the Sunshine Coast

At Zion Financial, we’re not your typical financial planners.

We’re a family-owned and operated financial advice firm based on the Sunshine Coast, passionate about helping everyday Australians build wealth, reduce stress, and create a financial future they feel proud of.

Whether you're planning for your child’s education, buying your first home, building an investment portfolio, or looking ahead to retirement — we’re here to walk the journey with you.

Why families and professionals across the Sunshine Coast choose Zion:

Down-to-earth, jargon-free financial advice

Specialists in education planning, superannuation, investing, and cash flow

Real-life modelling tools that make the future feel less uncertain and more exciting

A strong focus on financial wellbeing and personal goals — not just numbers

We're known for being approachable, trustworthy, and here for the long haul

We believe financial advice shouldn’t be intimidating — it should feel empowering, personal, and genuinely useful.

If you’re looking for a financial adviser on the Sunshine Coast or anywhere in Australia, who sees the big picture and the everyday details — we’d love to meet you.

Curious Where to Begin? Start Here:

Use the Futurity Cost of Education Calculator to estimate what school will cost your family over 13 years.

Then book a complimentary session with our team at Zion Financial. We’ll help you map out a strategy that supports your child — and protects your financial wellbeing too. Contact Us via the contact form today.